Find correlated stocks

If two stocks are highly correlated they will likely move in the. Pick a specific time period then add up the daily price of each individual stock for that.

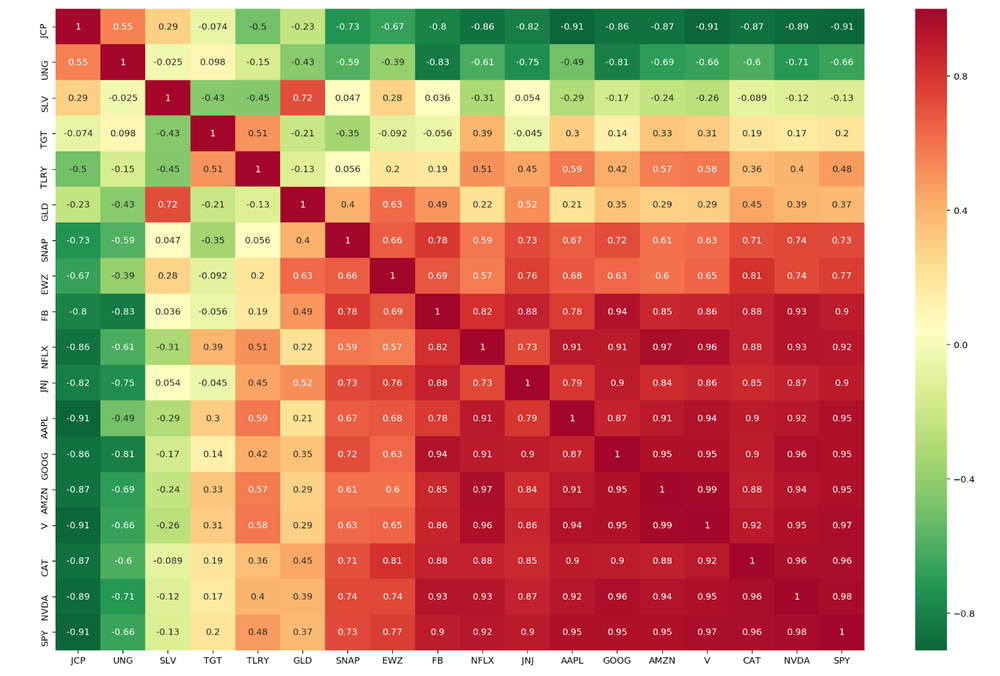

Easily Visualize The Correlation Of Your Portfolio In Python

Top 1000 Most and Least correlated assets on the market.

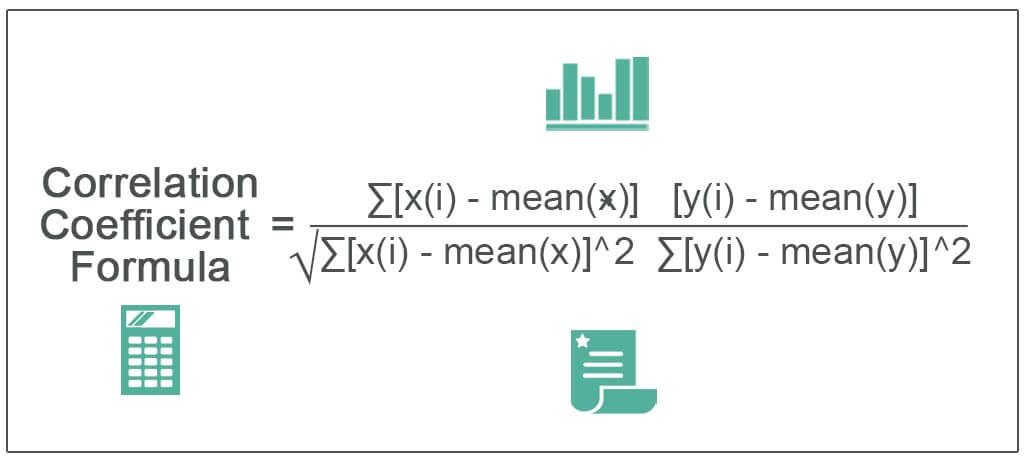

. For example if you want to find stocks that most closely move with Apple APPL type AAPL in the Ticker field and. To find the influence between two stocks you need to find the average price of each. Using the Pearson Correlation Coefficient we can determine.

Find top correlated stocks with any ticker you choose. Ad See how Invesco QQQ ETF can fit into your portfolio. From the Dashboard click on the word Analytics in the black bar at the top of the screen this will open a drop-down menu with Correlation.

There are more than 1600 companies listed in NSE which gives you more than 12 million. Correlation between stocks is a measure of how the returns of a stock interfere with the returns of another one. First log in to your HiddenLevers account.

Stock Correlation Calculator Use the Stock Correlation Calculator to compute the correlation coefficient for any stock exchange-traded fund ETF and mutual fund listed on a major US. When an investor says that X. These are two or more stocks whose performance runs parallel to one another.

A perfectly analog class has a correlation metric of 100 or 1. Pick a specific time period then add up the daily price of each individual stock for. How to Calculate Stock Correlation.

Every day we calculate more than 21000000 correlations yes 21 million among assets all over the world. It also has several scans which allow you to search for stocks that meet your requirements in terms of. This asset correlation testing tool allows you to view correlations for stocks ETFs and mutual funds for the given time period.

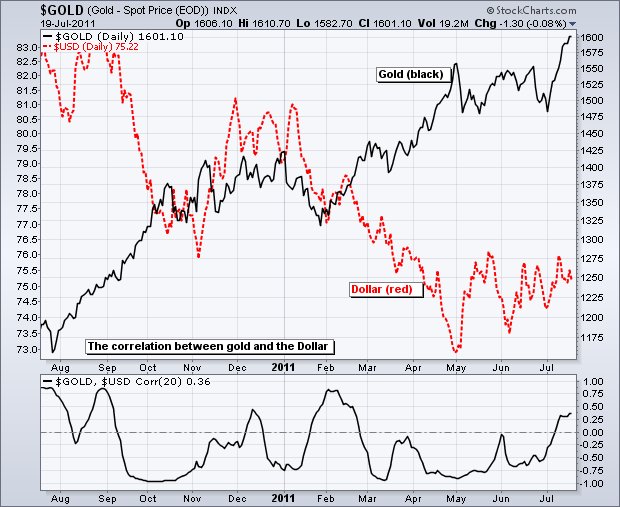

The exact relationship between stocks is expressed on a scale from -10 to 10. To find the correlation between two stocks youll start by finding the average price for each one. You also view the rolling correlation for a.

Youll be able to create heatmaps and various other charts showing stock correlations. Stock Correlation will give you the top 20 most highlyinversely correlated tickers. How do you find the correlation of a stock.

And from all of these. Ad A smarter way to execute your indexed annuity strategy. Stock Correlation is a tool to find positivelynegatively correlated stocks.

When two stocks increase together and decrease together at the exact same rate they have a perfect positive. Pick a period then shuffle each stocks. We can calculate stock.

Now that we understand stock correlation a little lets start to find out how to calculate a stock correlation. To find a correlation between two stocks you can start by determining the average affordability of each. Identify correlated stocks from FO stock list Finding a needle in haystack.

So with that important disclosure and disclaimer out of the way lets now think about how to calculate stock correlation. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. All Straight from Industry Pros.

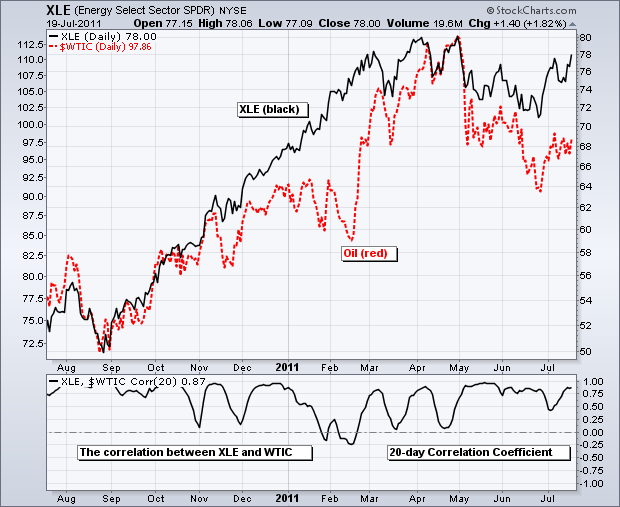

Correlation Coefficient Chartschool

Correlation Coefficient Chartschool

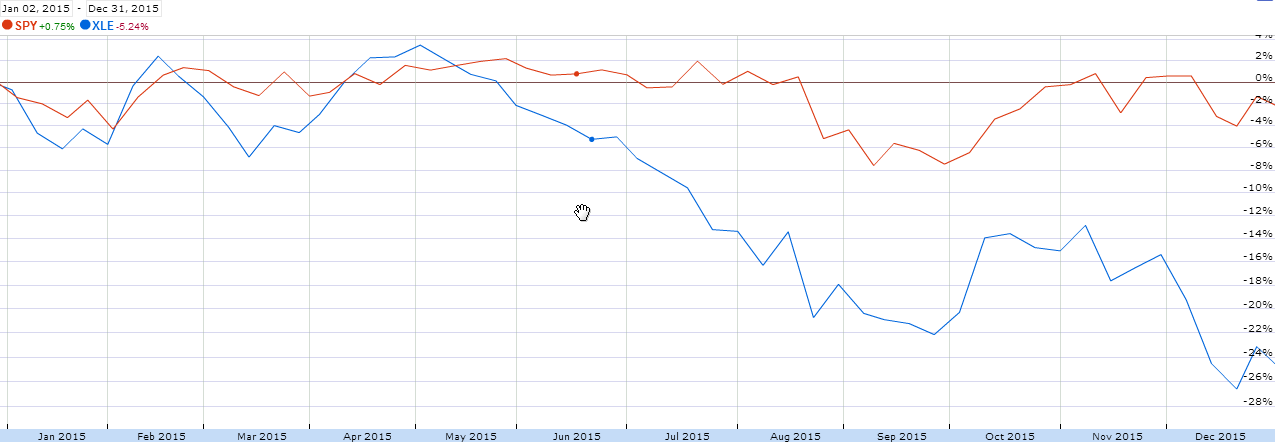

U S Stock Market Sectors Correlations Seeking Alpha

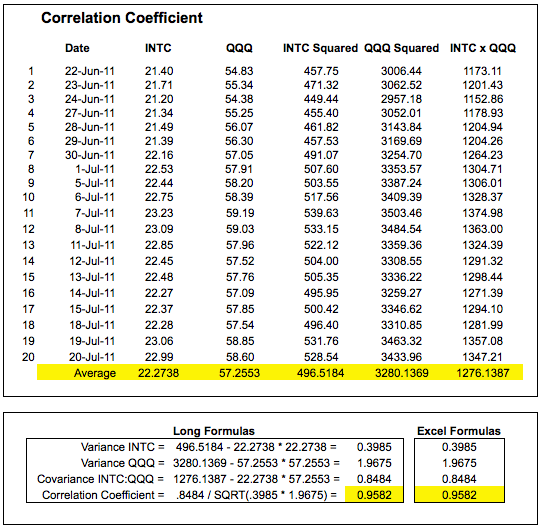

How To Calculate Stock Correlation Coefficient 12 Steps

How To Find Correlated Stocks And Alpha Beta Values Edgerater Academy

How To Calculate Stock Correlation Coefficient 12 Steps

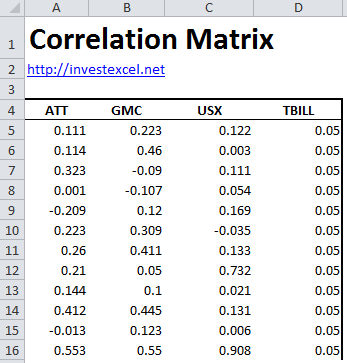

Correlation Matrix Guide And Spreadsheet For Investors

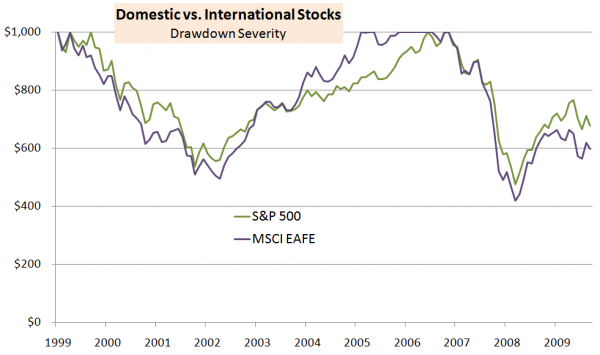

Diversification 10 Investments That Don T Correlate With The S P Seeking Alpha

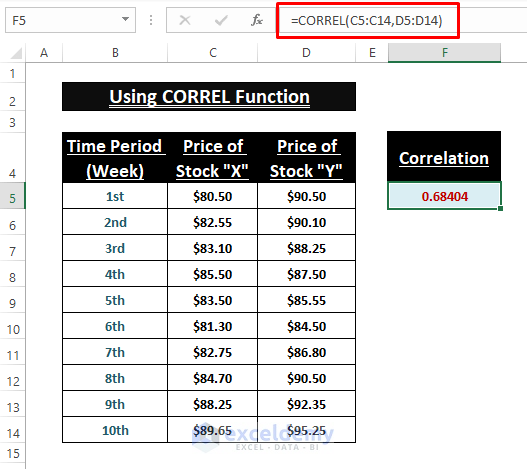

How To Calculate Correlation Between Two Stocks In Excel 3 Methods

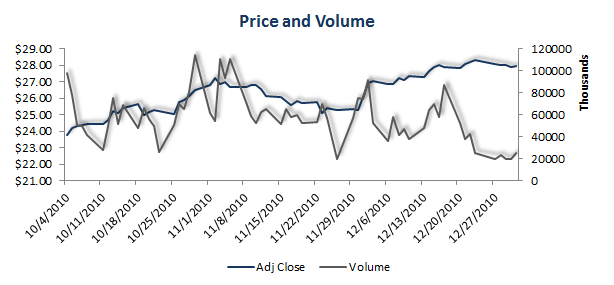

Price And Volume Correlation Seeking Alpha

What Is Stock Correlation And How Do You Find It

What Is Stock Correlation And How Do You Find It Smartasset

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha

How To Use The Correlation Coefficient To Build A Diverse Portfolio Tpa

How To Calculate Stock Correlation Coefficient 12 Steps

Correlation Coefficient Chartschool

Correlation Formula How To Calculate Step By Step